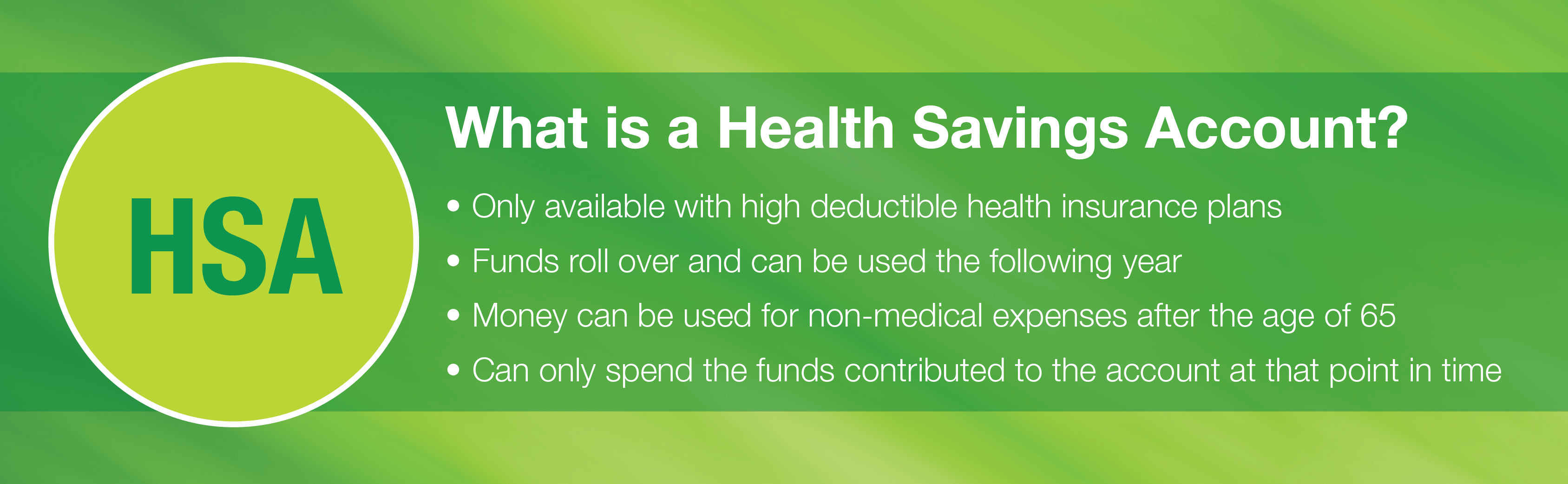

If you belong to a high deductible health plan, or HDHP, you pay a lower premium but are responsible for the bulk of your health care costs until you reach your deductible and your plan begins to pay for services. If that sounds like your plan, you probably know a bit about health savings accounts (HSAs). And if you just selected an HDHP, you’ll hear about HSAs very soon. In short, an HSA is an account you set up to help manage and fund your HDHP by saving, managing, investing and paying for qualified medical expenses for you and your family.

Much like a regular savings account, your HSA puts you in control of your deposits and spending, only just for your health care costs. Whether you’re familiar with these awesome accounts, out-of-the-loop entirely or a true HSA aficionado, the following five things are here to teach—or remind—you so you can make the best use of your HSA.

- They’re tax-free.

Whatever amount you or your employer (or any other contributor, for that matter) contributes to your plan is completely tax-free. Your HSA collects interest, meaning the amount in your account grows, tax-free. When you withdraw from your HSA to pay for qualified health care costs—you got it—your payments are tax-free, too. Just be sure you’re paying for qualified health care costs because the penalties are not tax-free. In fact, they’re far from it; the IRS will ask you to claim the payment amount on your income taxes, pay income tax on the amount AND pay a 20 percent penalty on top of taxes. So be sure to check out our list of qualified expenses so you always know which health care costs apply.

- Anyone can contribute.

Just because it’s your HSA doesn’t mean you’re the only one who can contribute. Your employer will likely contribute to your account. Family members may also make deposits. However, as the owner of your HSA, you alone decide how much to contribute, how to invest your funds, how much of it you spend, and which qualified medical expenses to claim. No matter who puts funds in to your HSA, only you take them out. And, good news— your balance stays in your account even if you change jobs, move or retire.

- Your family’s included.

When it comes to “sharing the wealth,” HSAs offer a big advantage. You can spend funds on your spouse or dependents (children or others on your health plan) to cover their qualified medical expenses. You can pay their health costs even if they’re not on your HDHP. While it’s technically your HSA, you may want to think of it as your family’s account—because it benefits them, too.

- Contributions retire when you do.

The minute you enroll in Medicare, the deposit window closes on your HSA. But that doesn’t mean the account closes and the party’s over. In fact, retirement brings many beneficial changes. For instance, you can begin using your remaining HSA balance to fund a wider range of medical services like your Medicare premiums, deductibles, copays and coinsurance costs (not including premiums for supplemental insurance plans). You can also use your HSA to flip the bill for company retiree benefits premiums that your previous employer may provide.

- You can invest the money in your account.

HSAs are similar to an Individual Retirement Account, or IRA, in that you can invest it in stocks, bonds, mutual funds and certificates of deposit. These investment types can help grow your HSA, so there’s money there when you need it. You can even place your HSA in a trust. There are many regulations, and we recommend discussing investment options, including which will work best for you, with the organization (bank or financial institution) holding your HSA. Remember, you’re the one in control of your account, but consulting with financial experts is always a great idea.

At Priority Health, we’re committed to educating members on the many ways they can become more engaged in their health, control their costs and get access to quality care. Go to our website for more information on our HSA program.