With this year’s Open Enrollment Period underway from Nov. 1 to Jan. 15, 2022, many people are shopping for insurance plans and looking for ways to save money on their health care costs in 2022. If you’re shopping for a plan, consider purchasing one that offers a health savings account (HSA) or a narrow network option. Here’s what you need to know about these two cost-saving options.

What’s an HSA and how does it work?

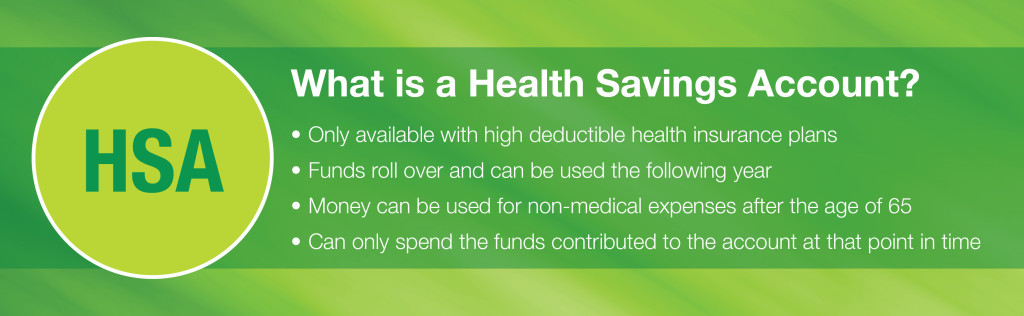

An HSA is usually paired with a high-deductible health insurance plan. An HSA is similar to any other savings account, but the money you contribute to it is exclusively for health-related services. An HSA helps you plan for and save money on any out-of-pocket health expenses such as copays, coinsurance or your deductible.

One of the biggest advantages of an HSA is that any contributions you make are not taxed and the balance grows tax-free. Any money that is unused rolls over into the following year, helping you build your health savings account over time. Some health plans, like Priority Health, make it easy to combine your high-deductible health plan with an HSA at no extra cost by providing a free banking partner.

All funds in your HSA account belong to you as the account owner, meaning it travels with you from one job to another, and into retirement. If you don’t need to make large withdrawals from this account for health care expenses, an HSA is also a great retirement planning tool. Once you turn 65, you can use the money for non-medical related expenses without penalty.

If you’re generally healthy, savings-minded and don’t anticipate needing major medical care, an HSA may be the right choice for you.

Is a narrow network right for me?

If you receive care from one health system (or are comfortable with that approach) and are interested in a lower monthly premium, a narrow network plan could be a great way to manage your health care spending. With a narrow network plan, your insurance only covers care received at providers within the narrow network, but are coupled with lower monthly premiums. The lower premiums balance out the limited network, especially if you only visit your doctor for routine checkups and don’t require many prescriptions. Make sure your preferred providers are within the network, or research health care systems before enrolling in a narrow network plan.

Ready to save money on health care costs? Shop Priority Health plans to find the best HSA and/or narrow network plan for you and your family.